Are you interested in Intraday trading but don't know about the easiest and most effective s...

-1650882599.png)

Are you interested in Intraday trading but don't know about the easiest and most effective strategies?

Here's a famous quote:

In this case, here are one of your best options is Intraday Trading Strategies & Techniques, which allows you to adapt quickly and help you make a profit out of Intraday Trading.

Intraday trading, often known as day trading, is where a person buys and sells financial assets such as stocks and shares on the same day. Even if intraday trading is a risky way to invest your money, you may profit if you trade with caution and techniques.

Intraday trading is a dangerous and unique technique to invest your money compared to traditional stock market investment.

This blog will cover the different intraday trading strategies and tricks that beginners should learn. Consider these tactics essential because there are other aspects to consider before beginning to trade. Back top ⇒

The stock market changes every second, and this method is based on taking advantage of that momentum.

Before a significant market movement occurs, we must follow the appropriate stock. Based on current headlines, mergers and acquisitions, profits, and other factors, stocks are chosen. Traders use this fluctuation to purchase and sell assets.

The price of a company might fluctuate due to various external reasons, so investors must keep up with the latest news on the equities they're tracking. The stock's market momentum determines the investor's holding period.

When purchasing and selling shares on the same day, precise timing is critical. The intraday trading method entails following a stock that has broken out of its regular trading range. A trader uses this approach to join the market when the stock's price rises over its resistance and support levels.

Breakouts need immediate entry and exit from the market with little time to waste. Traders determine the price level of the breakout and then wait for it to happen. This is a significant risk since there will be nothing left to buy following the breakout.

This trading method is more complicated than the others since it includes a significant level of risk. Investing decisions are made here against market tendencies but based on analysis and calculations. Traders are on the lookout for equities trading at extreme lows and highs. These stocks have a decent possibility of reversing their trend.

The transaction is performed when the reverse value comes to the deal's limit. When security moves backward, a stop is signaled. The traders then wait for the stock to reach its maximum range of movement.

This strategy makes money by exploiting slight price movements. It's a frequent intraday trading strategy for buying and selling commodities. Traders that participate in high-frequency trading employ this strategy. The primary and technological setup are of little importance in this scenario.

Traders who use this strategy should select both liquid and volatile equities. It's also crucial to set a stop loss. This is a well-known Forex trading strategy.

Another excellent intraday trading strategy is the moving average crossover strategy. When the price of a stock or other financial instrument rises above or below the moving average, Momentum has changed. An [Uptrend] occurs when the price of a stock rises above its moving average. On the other hand, a downtrend is defined as a downward movement in stock prices.

Traders are advised to adopt a long position and buy equities if the market is on an uptrend. Traders initiate short positions and sell their shares when the market is a downtrend.

Exposed In 2022

What is the most accurate trading indicator?

This strategy includes locating equities with no pre-market activity. Gapers are areas on a stock market chart when no trades have been performed. Earnings, takeover announcements, further rise, and other causes can contribute to the disparities. During market opening hours, these gaps are prevalent. Traders that use this strategy find these equities and buy them in the hopes of bridging the gap before the closing bell.

The pivot point trading strategy is often called the trader's best friend when it comes to pinpointing levels to generate a preference, place ends, and pinpoint possible profit benchmarks for trade.

Traders use pivot points both on commodity and stock exchanges. It is calculated relying on the prior trading sessions' highs, lows, and close prices and predicts support and resistance levels in the current or upcoming session. Traders can use support and resistance levels to determine entry and exit points for stop losses and profit-taking.

Traders use pivot points in equity and entity interactions. They're estimated based on the heightened, downward, and closing prices of earlier trade sessions, and they're used to forecast help and resistance levels in the present or forthcoming session. Traders can use these support and antagonism ranks to decide entry and exit points for stop-losses and profit-taking.

Hot Topics

Aussie Media Company Goes On NBA Fan Engagement With NFTs!

Traders that use this strategy search for a situation in which a long-term trend is being pushed in the other direction. While following the trend, this strategy keeps him from losing. The weakness is bought and the strengths are sold in this strategy. After a breakout, it's an excellent time to purchase pullbacks.

Fading, also known as contrarian strategy, is when traders enter a high-momentum trend with the opposite circumstances.

As prices change against the real bid-ask, a market dealer or broker who does not hold his bid or offer for an extended period of time is said to fade their markets.

Prompts are frequently used with fading and other applied behavior analysis (ABA) tactics. Fading is reducing the amount of help needed to complete tasks or activities. The overarching aim for the learner while teaching skills is for them to participate in the activity independently.

Fading is an anti-trend trading strategy. Rather than following the trend of a monetary instrument, traders want to go against it.

Because price swings in the market are huge, there are always overreactions, and the fading strategy says that when a stock price is on an unsustainable run for the lid, investors will quickly take gains, sending prices back down.

As a result, you may swiftly sell stocks by using the fading strategy, taking advantage of the drop as profit-takers make their bets.

People's daily lives have been revolutionized by technology. It is now engaged in almost every aspect of life. As Robo-trading becomes more prevalent, the stock trading strategy will inevitably change.

This Robo-trading strategy differs from investing through Robo-advisors such as Betterment or M1 Finance in that it focuses on long-term investment plans. Robo-traders are trading machines that produce trading signals using complex algorithms and frequently execute transactions on behalf of traders or customers.

The cost of robo-trading systems is generally rather high. However, the capacity to trade without dealing and succeeding at it is a priceless notion. Back top ⇒

Here are some essential Intraday trading tips:

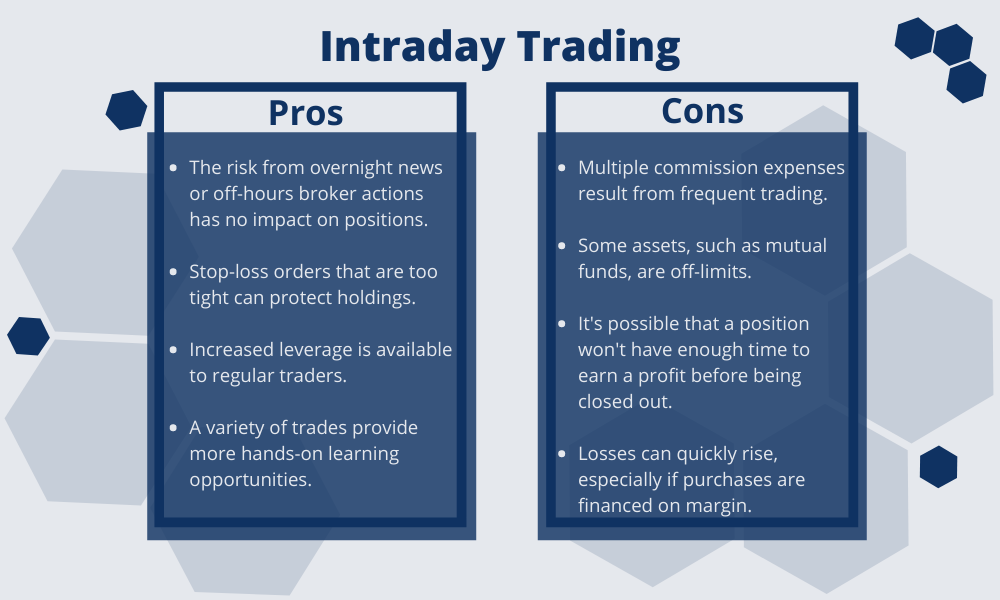

The most significant benefit of intraday trading is that positions are not affected by the possibility of negative overnight news that can potentially impact the price of securities materially. Such information includes vital economic and earnings reports and broker upgrades and downgrades that occur either before the market opens or after the market closes. Back top ⇒

Among the different trading techniques, these are the most popular and commonly utilized strategies. The key to intraday trading success is having a thorough understanding of what you're going to invest in, patience, and making timely and precise decisions. You should never consider it a pastime, but rather an investment in yourself before putting your money into it. You should also stay up to speed on the newest stock market news and developments.