Risk control is an essential part of trading. The sooner a trader understands its significance,...

Risk control is an essential part of trading. The sooner a trader understands its significance, the quicker he will begin to earn income at Forex.

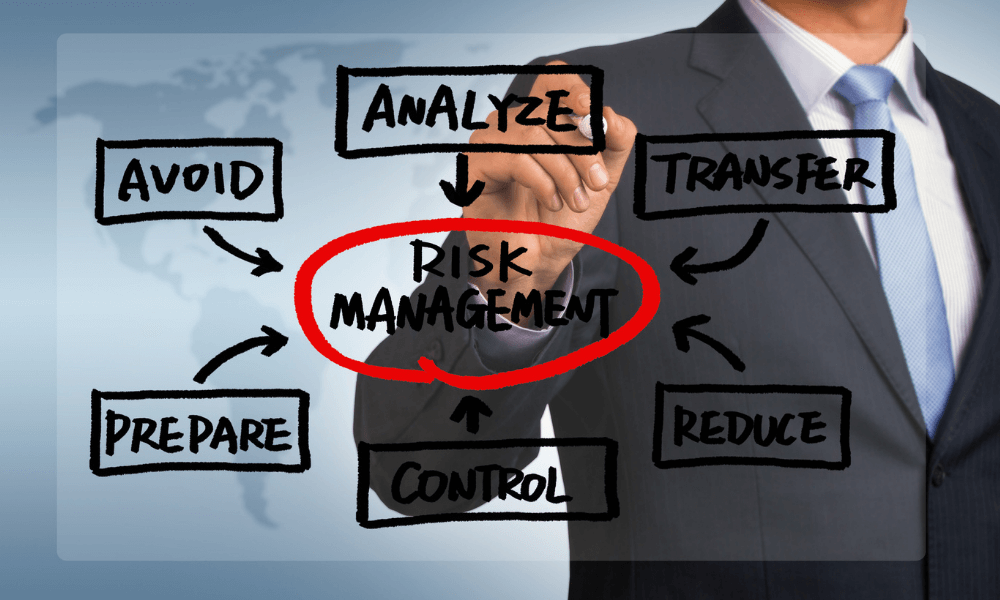

It is important to incorporate risk management into your trading system; however, the truth is that only experienced traders can efficiently manage their capital. However, do not forget they also used to be beginners. So, read and learn!

Why Risk Management Is An Integral Part Of Trading At Forex?

For many people who begin to trade in the currency market, it is very difficult to accept the fact that trading always involves risks and the task of a trader is to minimize these risks.

Some beginners ignore risk management and do not achieve success in trading, shifting to some other type of business, which seems safer to them. Let’s consider the following example:

How many professional drivers have ever thought that their job is always associated with risk, and one of their tasks is to minimize existing risks? It seems that only a few people are aware of these risks.

There are lots of drivers on the roads, good and bad, experienced and beginners; you can even meet a drunk driver or a sick one on the road. There are also plenty of different types of pedestrians.

Plus to this, there are slippery roads and potholes on the roads. Professional drivers have to face these facts every day. But who thinks about all these difficulties when a person receives his/her driving license?

At the same time, when people join the world of trading, they think about the risks, although the situation on the roads is similar or maybe even more dangerous than in trading.

Note also that income of a driver cannot be compared with the profit, which a person can receive in the currency market.

Forex trading risk-free sounds so unreal to an average forex trader. How is it possible to trade forex without risk when in every trade, about 85% of participating traders are unsuccessful?

It may sound farfetched but it is possible to trade forex with little or no risk at all. Here are some things every forex trader should do to avoid losing money in the market as a result of risks.

How To Minimize Forex Risks?

So, what to do? In order to minimize risks, a driver follows traffic rules on the roads and applies some practices in order to increase vigilance. A trader does the same thing.

First of all, a trader uses indicators, and reviews important macro-economic data that may confirm the signals, etc.), secondly, a trader has to undertake some additional steps in order to protect capital.

Risk & Money management is one of the most important and fundamental trading skills that any trader needs to dominate in order to become consistently profitable.

In the following educational video, the trader will attempt to address this complicated (and usually overlooked) subject by sharing his money management tactics and demonstrating his real-time open positions.

Tips To Ensure A Risk-Free Forex Trade

Prior to opening a position, a trader shall thoroughly analyze the market. It means that a trader shall analyze signals of trading indicators and wait for their confirmations.

A trader shall clearly understand the situation in the market. A trader shall read analysts’ reviews, track economic news, and study the economic calendar.

Your trading strategy must incorporate every step you are going to make in the market. If you feel that some of the important details are missing in the trading strategy, you should make some improvements to it.

Your strategy should represent a clear plan, an action guide, which will include all necessary details.

Risk diversification is the most important point of all trading strategies. Ensure that your trading instruments correlate with each other, as it helps to minimize risks.

There are many methods of risk diversification; just learn more about them. Stop losses are also of great importance for a trader. Do not forget to place them when you place a trading order.

They protect you from losses and enable you to gain profit. There are various methods of placing stop orders – you can choose what is more suitable for you and apply them in trading.

Trading in trend may seem boring if you want something unusual, as it is a classical type of trading, and therefore, the most reliable and predictable.

Although trading in trend is usually recommended for beginners, many experienced traders also choose this type of strategy. A trader shall place stop-loss and take profit orders in order to reduce the risks of losing money.

Keep yourself in hand! Set aside all your emotions and rely on your trading strategy. Follow your trading strategy, instead of submitting to your emotions (greed, resentment, fear, and so on).

We have spoken about trading risks and the main rules of trading. However, there are also non-commercial risks, such as malfunction of computers, network interruptions, slippage, and so on.

Please be aware of them too, and try to minimize them as well.

Dear friends! We wish you successful trading! (Source)