Market fluctuations are caused by people, that’s why the market is often compared with a l...

Market fluctuations are caused by people, that’s why the market is often compared with a living being.

For example, Bill Williams associated it with a sleeping alligator: the more it sleeps, the more hungry it gets. Isn’t it an appropriate comparison with consolidation?

The longer it lasts, the likelier an explosive movement is. The author of the chaos theory developed an indicator of the same name. Its combination with fractals makes an efficient trading strategy.

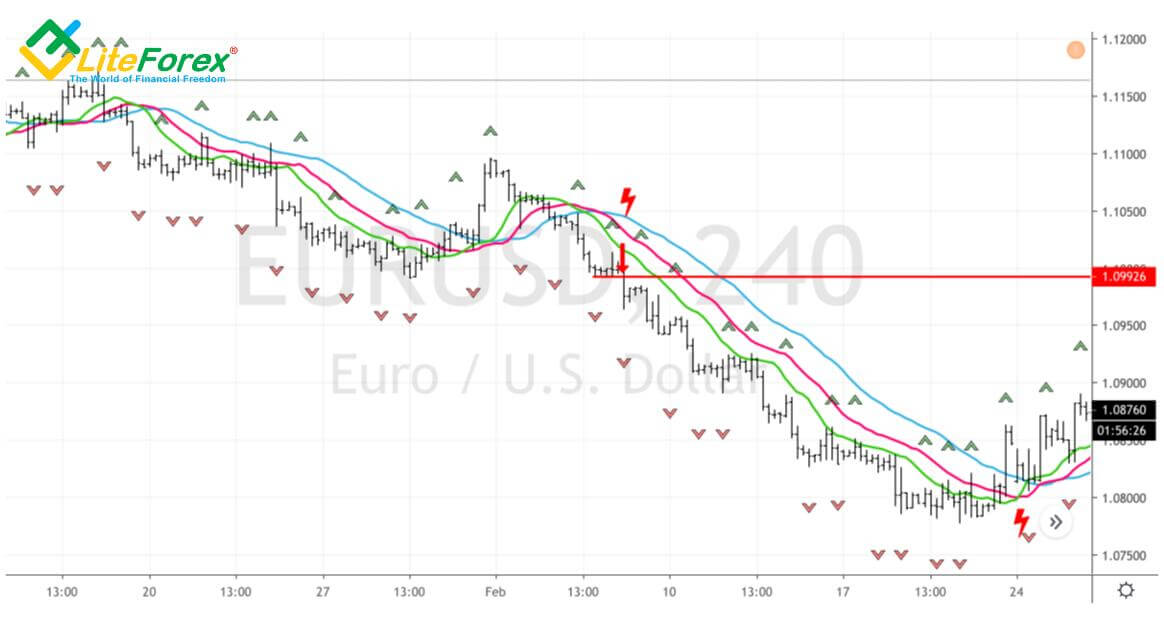

An Alligator is a system of moving averages shifted forward, each of them having its own name and functions:

- The blue line, Alligator’s jaws; SMA-13 shifted 8 bars forward. Williams believed that was the level at which prices were supposed to be in the nearest future unless something unexpected happened.

- The red line, Alligator’s teeth; SMA-8 shifted 5 bars forward;

- The green line, Alligator’s lips; SMA-5 shifted 3 bars forward.

I’m not going to go into much detail. I’ll only say that the main condition for building a strategy based on Alligator+fractals is an intersection of moving averages, i.e. consolidation.

If a trader detects it in the market and plans to open a short position, he/she needs to find a bar that complies with the following:

- it must contain a downward fractal;

- the range (spread) of this bar must be below all the 3 lines of Alligator, i.e. they mustn’t have any areas of contact.

Such a bar formed after consolidation in the H4 chart of EUR/USD at the beginning of February. So, a trader could use the Alligator+fractals strategy.

Basic Conditions For Forming A Signal To Sell EUR/USD

A pending order to sell should be placed at the lowest of the key bar.

The authors of the strategy recommend placing a stop order at the maximum level of the previous upward fractal, but it is very narrow, just 16 points, in the example with a long position in EUR/USD.

Alternatively, a protective order may be placed at the level of the Alligator’s teeth or red SMA. Its volume will finally grow up to 35 points, which is quite appropriate for the H4 time frame.

Selling EUR/USD based on the Alligator+fractals strategy.

According to the authors, take profit should be placed at 55 points. Or use trailing stop once the price has moved 20 points.

In my opinion, consolidation, i.e. intersection of moving averages, will point to a potential trend change. Such an approach may substantially increase profits.

They were 130 points in the example of EUR/USD. The same method is used for buying. Once SMAs intersect, find a bar that complies with the following conditions:

- It must contain an upward fractal;

- The range (spread) of this bar must be above all the 3 lines of Alligator, i.e. they mustn’t have any areas of contact

A trader needs to place a pending order at the maximum level of the key bar and a stop order - at the level of the red SMA.

Then hold a position until consolidation forms. The long position in EUR/USD opened using this strategy has already yielded 300 profit points and it hasn’t been closed yet.

Buying EUR/USD based on the Alligator+fractals strategy. So, I think that the Alligator+fractals strategy is quite efficient when the market stops consolidating and starts trending.