Alibaba is investing further in Europe for Singles Day this year, as the Chinese tech giant competes...

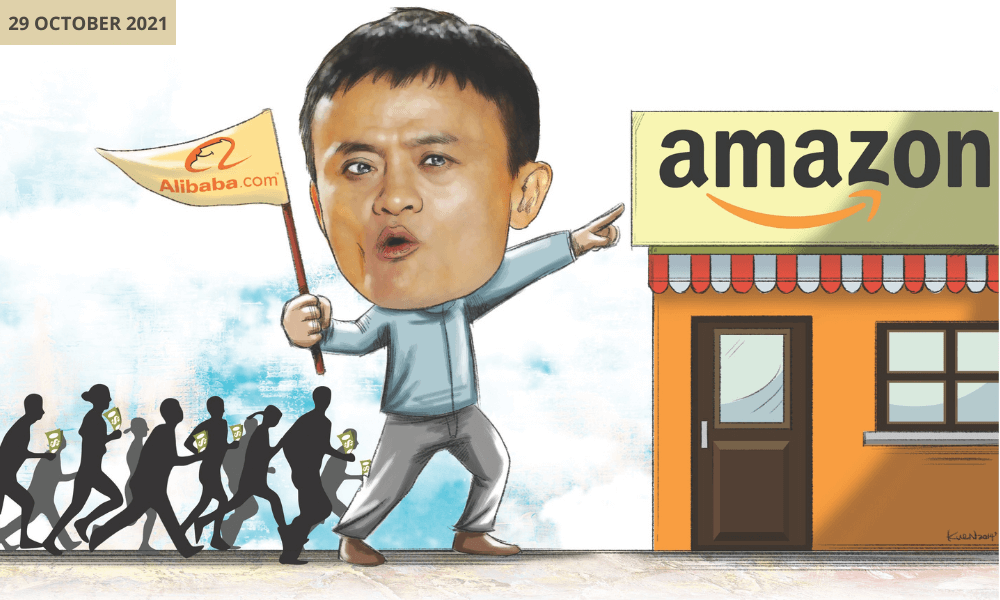

Alibaba is investing further in Europe for Singles Day this year, as the Chinese tech giant competes with Amazon for the European Union’s exploding e-commerce market.

Alibaba remained among the top three online sellers of consumer goods in eastern Europe last year, according to Euromonitor International.

Amazon wasn’t on the top 10 list for the region, which includes countries like Poland and the Czech Republic.

Amazon is by far the top seller in western Europe, which includes France and Spain, according to Euromonitor.

But the U.S. e-commerce giant’s market share in the region did not grow during the pandemic, remaining at about 19.3% in 2020.

In contrast, Alibaba’s market share increased to 2.9% in 2020, up from 2% the prior year, the data showed.

Alibaba held first place in eastern Europe e-commerce in 2019, according to Euromonitor International.

But Polish online shopping site Allegro took first place in 2020 during the pandemic, while Russian rival Wildberries took second, according to the data.

The competition for Europe comes as online shopping in the region got another lift this year.

Stay-home policies and other social distancing measures have remained in place for many months amid a prolonged fight to control multiple waves of Covid-19 outbreaks.

“It’s time for the next stage of e-commerce growth in Europe,” NielsenIQ said in a report in June.

For “fast-moving consumer goods” — a category that includes food, beverages, personal care, and home care.

The report said e-commerce sales growth doubled in Italy and Spain in the first quarter of this year, compared with the same period in 2020.

Alibaba Prepares For Singles Day — In Europe

Alibaba is keen to ride that wave of growth. Different business units have announced expansion into Europe in the weeks leading up to the Singles Day shopping festival.

The shopping event, spearheaded by Alibaba in China, is similar to Black Friday in the U.S. or Amazon’s Prime Day. Singles Day is also known as “Double 11” since it falls on the 11th day of the 11th month of the year — Nov. 11.

In recent years, Alibaba has promoted the shopping festival overseas through its own e-commerce website for selling to consumers outside of China, called AliExpress.

The platform mostly connects Chinese sellers with overseas buyers, allowing foreign businesses and consumers to buy directly from factories in China.

Spain, Russia, and Brazil are among the core countries for AliExpress’ overseas expansion, Li Dawei, head of AliExpress Supply Chain, told CNBC in a Mandarin phone interview earlier this month.

Alibaba founder Jack Ma is reportedly traveling in Europe this month to study local agricultural practices and technology, in his first trip away from greater China in more than a year.

The company referred CNBC to the Jack Ma Foundation, which did not immediately respond to a request for comment.

Subsidizing Delivery Costs

AliExpress plans to double its subsidies for international logistics support this Singles Day from last year. That’s a slowdown in pace from the company’s claims last year that it spent five times as much on subsidies as it did in 2019.

AliExpress claimed, during a period of global shipping congestion, that it did not raise costs for customers and hasn’t seen any major delivery delays because of its reliance on charter flights.

Most goods sold through AliExpress are also small consumer products and don’t need to be transported by ship.

For Singles Day, AliExpress said weekly overseas charter flights will increase to 100 a week from Nov. 11 and 30, up from 80 a week.

Once the packages leave China, they can be distributed at logistics arm Cainiao’s sorting centers, six in Europe and one in Russia, according to the company.

The shopping festival has also sped up investment in package lockers, which allow couriers to deliver many packages to one neighborhood’s residents at once.

In early September, Cainiao announced it had installed a network of 170 lockers in Madrid and Barcelona in Spain, and more than 80 in Paris, France.

The logistics unit said it planned to install a total of 5,000 lockers globally before Singles Day, especially in Russia, Poland, Spain, and France.

Cainiao and international commerce retail revenue both grew by at least 50% in the quarter that ended June 30 compared to a year ago, with the business segments each accounting for about 5% of Alibaba’s overall revenue. (Continue reading with CNBC)