Forex Indicators are considered to be an essential part when trading in the forex market. ...

Forex Indicators are considered to be an essential part when trading in the forex market.

In the world of Foreign exchange, Forex indicators are playing an IMMENSE role since the edge of time ( when the modern trading world was formed).

Numerous Forex traders across the trading sphere utilize the technical indicators in order to BETTER understand the price movement( when to buy and sell) of the FX market.

Not to mention, understanding the market movement ( the complete procedure) is known by technical analysis too.

As a reason, it goes without saying that every market trader should always be aware of the technical indicators. And...

Keeping that in essence, today I'll be shed a light on "5 most important technical indicators". Therefore, without any further ado,

Let's dive right in...

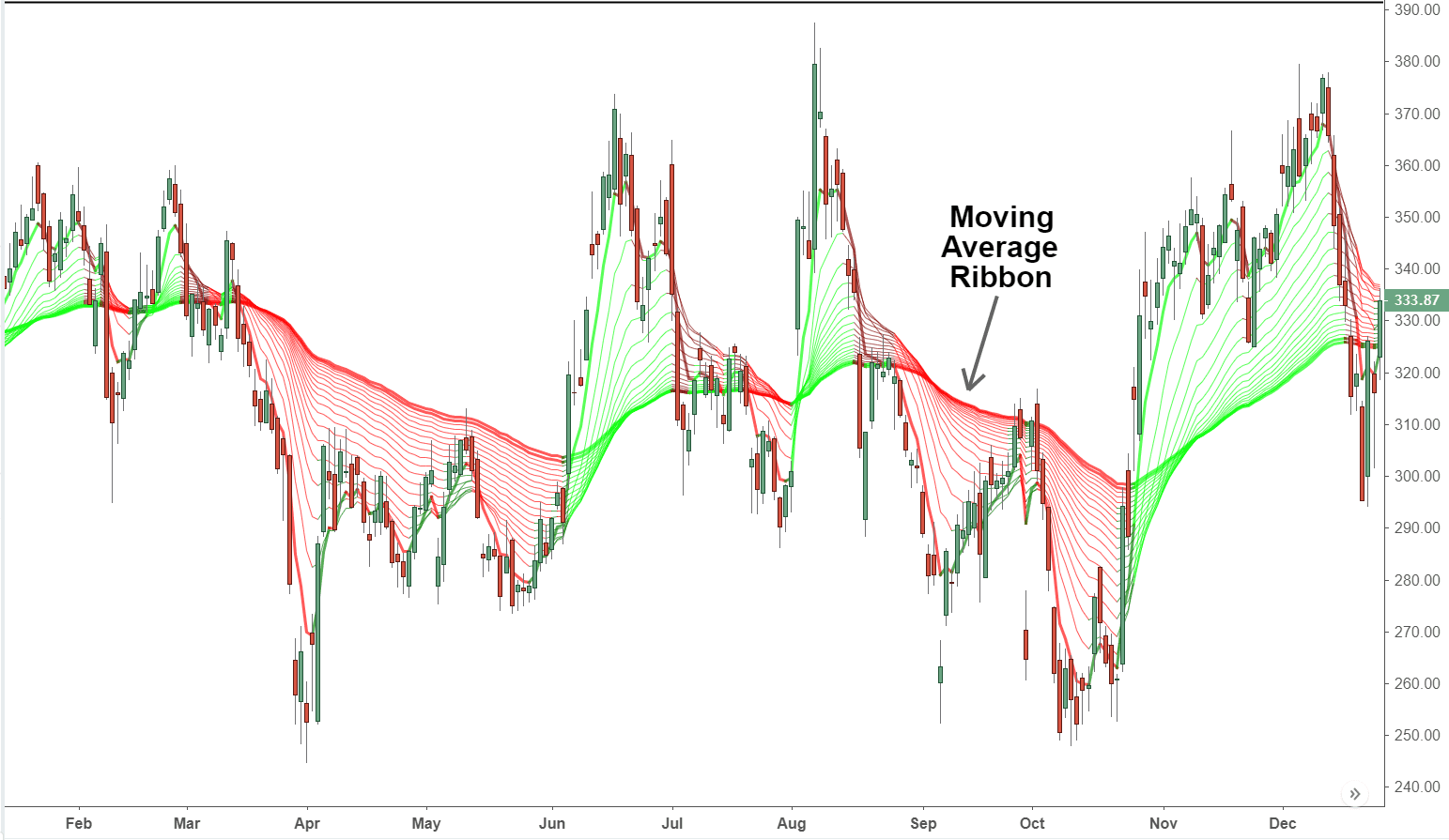

The Moving Averages

The idea of Moving Average is HUGELY vital that's why every trader should know about them. The national bank and global organizations drive the Forex market. Consequently, get what's going on at the large scale level.

The moving average is one of the Forex indicators that is the normal cost of the last number of candles that address the general feeling of the cost.

On the off chance that the cost is trading over the moving average means that purchasers are controlling the cost.

Then again, if the cost is exchanging beneath the moving normal, it implies traders control the cost.

Hence, in trading, you should stop entering trades if the cost is over the moving average. It is one of the most incredible Forex indicators that a trader should know.

Besides, the basic moving average proves the normal cost of the last number of candles that assists traders with understanding the market setting.

Then again, the outstanding moving normal spotlights on the latest development that assists traders with entering a trade.

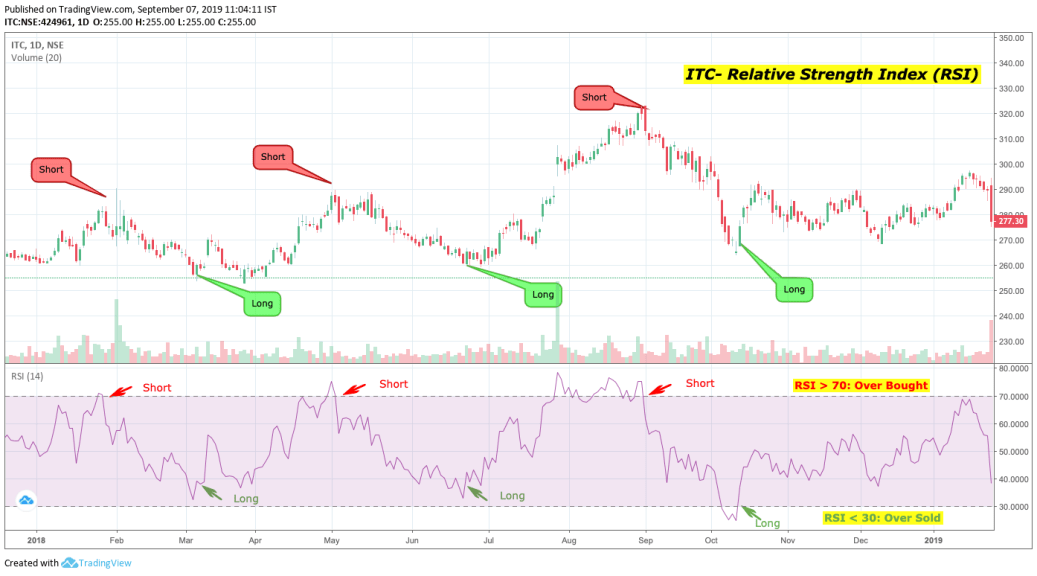

Relative Strength Index

The Relative Strength Index is also a WIDELY popular trading indicator across the forex market that reaches from 0 to 100 levels. This pointer demonstrates where the cost is probably going to switch.

In an uptrend, when the value moves over the 70 levels, it showcases a negative market inversion. Essentially, if the value moves beneath the 30 levels in a downtrend, it showcases a bullish market inversion.

MACD

When it comes to Convergence and Divergence, MACD (Moving Average Convergence and Divergence) will always stay as one of the top tier and widely used trading indicators.

MACD is a trading indicator that comprises a histogram and an outstanding moving average. The primary objective of this indicator is to ascertain divergence with the cost.

The average divergence with MACD and cost shows a market inversion, while their secret divergence shows a market continuation.

Traders regularly use it as an essential marker to make a trading strategy. Then again, you can utilize this marker to track down a potential market inversion point or a continuation point.

Besides, you can enter the exchange as per a trading strategy dependent on other mt4 indicators.

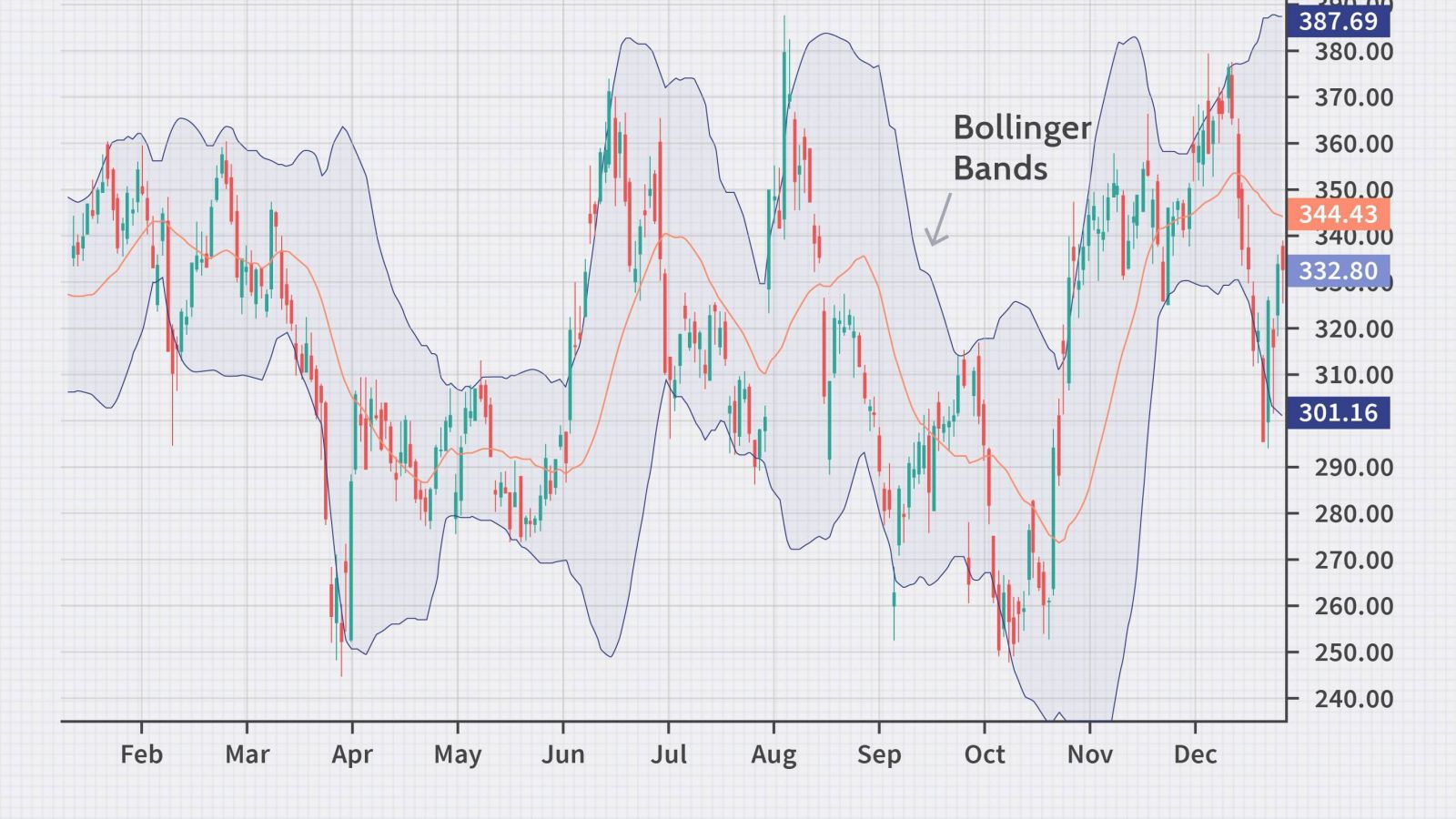

Bollinger Bands

John Bollinger made the Bollinger Bands indicator which is one of the best Forex indicators of all time. The principal component of Bollinger bands is moving midpoints.

So, you get the idea!

There are two standard differences in potential gain and the drawback and an old-style moving average in the center.

Generally speaking, this trading indicator is extremely simple to employ and gives a solid trading section.

The upper and lower line in the Bollinger bands indicator function uniquely to help the resistance levels.

Any displacement from these levels showcases a likely section. Besides, any breakout from these levels additionally gives beneficial trading momentum.

In any case, a candle close beneath or over the center line makes the chance of testing a higher level

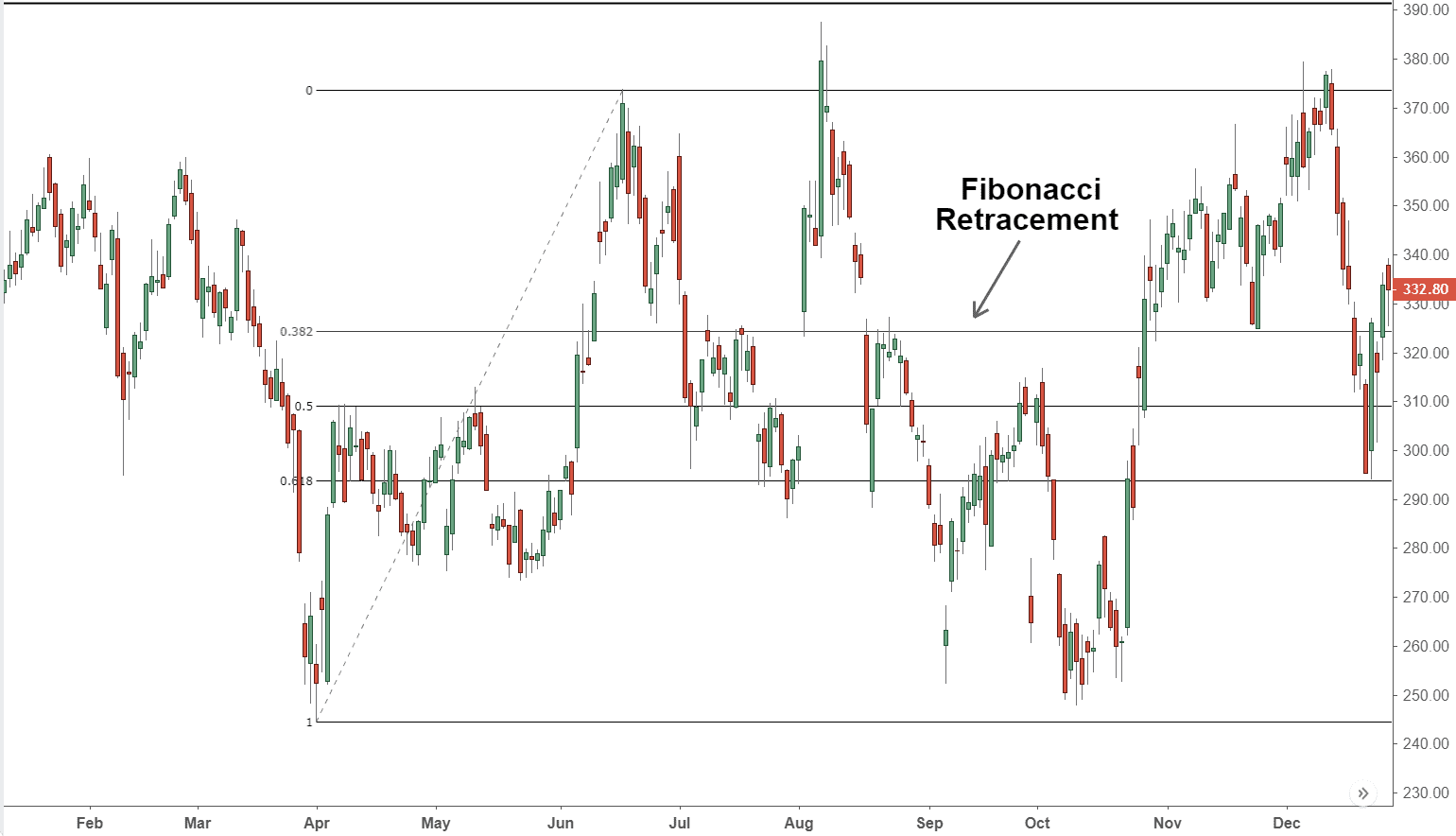

The Fibonacci Retracement

Fibonacci is a trading indicator that shows the most reliable market course as it has the recognition of numerous traders across the globe.

The main piece of the Fibonacci trading indicator is the brilliant proportion of 1.618. In the Forex market, traders utilize this balance to recognize market inversion and the benefit taking price area.

On the off chance that the value moves with a trend, right towards 61.8% Fibonacci retracement, and shows a market reversal, the cost will probably move 161.8% Fibonacci expansion level of the current leg.

Well, it gets even BETTER than that!

Moreover, in view of the market conduct and force, there are other Fibonacci levels like 23.6%, 38.2%, 50.0%, 88.6%, 127.0%, 261.8%, and so on. (Source).